How I improved Liquidity Engagement for 52K+ DeFi Users

Details

Waves.Tech

Client

UX/UI Designer (Team of 2)

Role

2023

Year

Complex wallet integrations in DeFi apps led to low user engagement and high abandonment. My task was to simplify liquidity management, improve portfolio tracking, and enhance user engagement in staking and rewards.

Overview

TL;DR

Problem

Cluttered interfaces, confusing data, and complex wallet integrations in DeFi platforms led to poor navigation and low engagement in liquidity pools and staking.

What I Did

Designed a Mobile first platform with clear APR visuals, real-time data, and seamless wallet integration to simplify liquidity management, staking, and rewards for all users.

Context

WavesTech’s users, both novice and experienced, were struggling with real-time data accessibility and

the steep learning curve of managing crypto investments.

Secondary Research Insights

70% of new crypto users abandon DeFi platforms

due to overly complex interfaces and unclear guidance on basic actions such as staking and liquidity management

40% of active DeFi users report difficulties in tracking APR

and understanding real-time data, leading to missed opportunities for better returns

50% of users expressed dissatisfaction with wallet integration

on existing platforms, citing challenges in connecting their wallets and managing their portfolios effectively

Primary Research Insights

(Conducted moderated user interviews and surveys with 20 novice and experienced crypto users to understand their pain points)

Beginners frequently abandoned platforms

due to confusing jargon and a lack of guidance on how to stake or add liquidity.

Experienced users were frustrated

by the lack of real-time APR tracking and poor data visualization, complicating liquidity pool management.

Both groups wanted better wallet integration

and a more intuitive user flow for liquidity and staking, with real-time feedback and portfolio clarity.

User Journey Map

(See enlarged version here)

Summary of Opportunity Areas

Easy Onboarding: Simplified wallet setup with clear guidance.

Intuitive Navigation: Filtered liquidity pools with APR insights.

Seamless Staking: Transparent APR, fees, and simplified forms.

Real-Time Tracking: Centralized portfolio & performance dashboard.

Instant Withdrawals: Easy liquidity access & reward claiming.

User Engagement: Personalized alerts & community features.

Problem Statement

How might we simplify DeFi by making data clearer, wallets easier, and liquidity more accessible?

Early concept testing

(moderated) with a control group of 15 novice and experienced DeFi users to evaluate usability across key features.

1. Liquidity Pool

Real-time data on liquidity pools, APR, and rewards.

Metrics and performance indicators simplify pool selection for better decision-making.

Feedback: The amount of real-time data overwhelmed some beginner users.

Insight: Progressive disclosure (e.g., hover-over tooltips) for complex terms like APR could reduce confusion for novice users while keeping experts satisfied.

2. Swap Feature Token Selection

Simple dropdown options for token pairs.

Slippage Settings: Customizable slippage tolerance for optimal transaction rates.

Real-Time Token Values: Shows value and equivalent amounts before confirming the swap.

Review Swap: Breakdown of pay/receive details, slippage tolerance, and transaction route.

Feedback: Several users struggled with understanding slippage tolerance and how it impacted their transactions.

Insights: Include a brief explanation or example next to the slippage setting to help users adjust it according to market conditions.

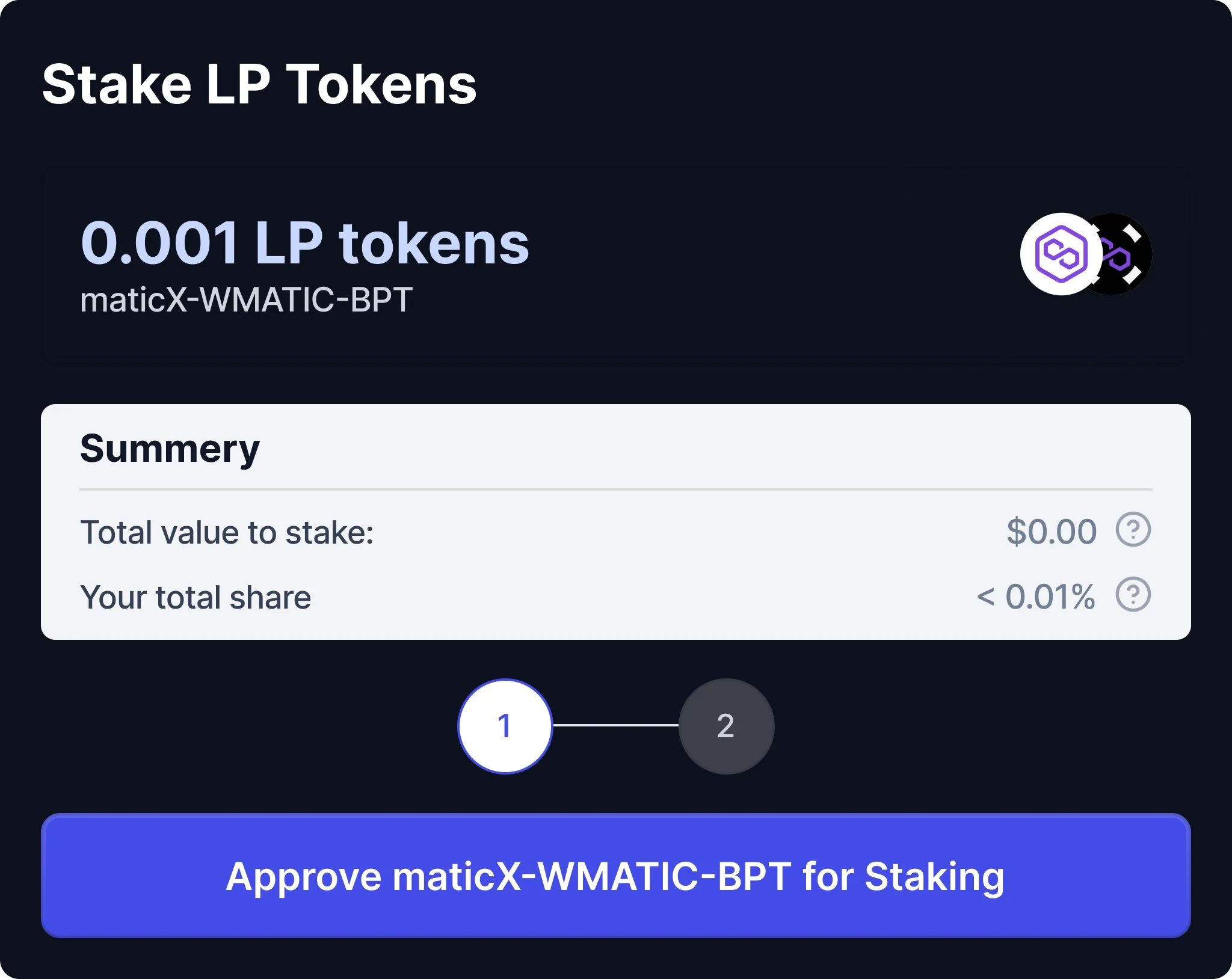

3. Stake for Incentives

One-click staking for rewards.

Add/Remove Liquidity: Simple liquidity contribution and withdrawal actions.

Token Search & Slippage Settings: Quick search, dropdown options, and adjustable slippage tolerance.

V1: Prioritizes detailed breakdown with boost multiplier and clear APR separation for transparency.

V2: Streamlines information by condensing layout, making it more scannable for quick decision-making.

Guide Wizard where users might need more information

Feedback: A few users found the staking process complex and expected a more guided flow for first-time stakers.

Insight: A step-by-step wizard for staking could simplify the process for beginners and encourage greater participation.

Information Architecture

Key Strategy

Small Tasks: Simplified, smaller steps for complex processes

Minimized Confusion: Reduced decision fatigue

Access to Critical Features: Staking, pool creation with minimal friction

Real-Time Feedback: Boosts user confidence

Seamless Transitions: Smooth task progression

User Engagement: Suitable for both new and experienced users

Design System

Introducing

LiquidFi

Wallet Integration and Onboarding

Wallet Explanation: Simple, clear explanation of wallet functions.

Supported Wallets: Integration for MetaMask, Coinbase, etc.

Connect Wallet CTA: Bold, visible button for seamless connection.

1.

Liquidity Pools Overview & Real-Time Data

Add Liquidity Button: Easy-to-find action button for pool engagement.

Pool Information: Displays clear TVL, APR, and reward data with color-coded performance indicators.

Charts & Graphs: Visual representation of 30-day pool performance and liquidity data.

2.

Portfolio Management & Staking

Portfolio Dashboard: Overview of claimable incentives and staked assets.

Stake Pools: Pool value, APR, and staking options easily accessible.

3.

Creating & Managing Liquidity Pools

Create Weighted Pool: Step-by-step setup with real-time previews.

Pool Summary: Shows token prices, composition, and fees before finalizing.

4.

Swap Feature

Token Selection: Simple dropdown options for token pairs.

Slippage Settings: Customizable slippage tolerance for optimal transaction rates.

Real-Time Token Values: Shows value and equivalent amounts before confirming the swap.

Review Swap: Breakdown of pay/receive details, slippage tolerance, and transaction route.

5.

Review Swap

Pay/Receive Details: Shows token amounts for both input (wstETH) and output (ETH).

Slippage Information: Displays max slippage tolerance and expected received amount.

Transaction Route: Clear breakdown of the exchange path and token conversion.

Key Design Tokens & Actions

6.

Stake for Incentives: Simplified staking to earn rewards.

Add Liquidity: One-click option to contribute liquidity.

Remove Liquidity: Easy access to withdraw funds from liquidity pools.

Slippage Settings:

Customizable slippage tolerance (1%, 2%, 3%),

Toggle for using signatures.

Staking Tokens:

Summarized staking details (total value, share),

Confirmation buttons for approval.

Token Search:

Dropdown options for selecting tokens,

Quick filter and search bar for easy navigation,

Display of popular tokens.

Impact

Liquidity Engagement 50% ▲

Participation rate: 30% → 50%

Clear APR visibility and real-time updates encouraged more users to engage with liquidity pools.

Staking Engagement 65% ▲

Staking participation: 25% → 65%

Streamlined staking and real-time reward tracking made it easier for users to participate.

Drop-Off Rates 35% ▼

Drop-off rate: 40% → 35% drop-off rate

Simplified wallet integration and onboarding reduced friction, improving user retention.

Reflections

When financial tools are confusing, users disengage and distrust.

Straightforward design makes complex tools accessible to all users.

📊 Designing for FinTech Requires Clarity

Complex DeFi concepts like APR and liquidity overwhelmed users. Simplifying data visualization and using progressive disclosure built trust and engagement.

🔍 Balancing Simplicity & Functionality is Key

User testing revealed that minimal interfaces helped new users, while experts needed detailed insights. Iterative design ensured the right balance for both.